"Well, in our country," said Alice, still panting a little, "you'd generally get to somewhere else — if you run very fast for a long time, as we've been doing."

"A slow sort of country!" said the Queen. "Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!"

- "Through the Looking Glass" by Lewis Carroll

The Myth of "Energy Independence" in the United States: Running with the Red Queen

The energy situation in the United States is currently a lot like this scene from "Through the Looking Glass," in which Alice and the Red Queen are running faster and faster but still don't seem to get anywhere.

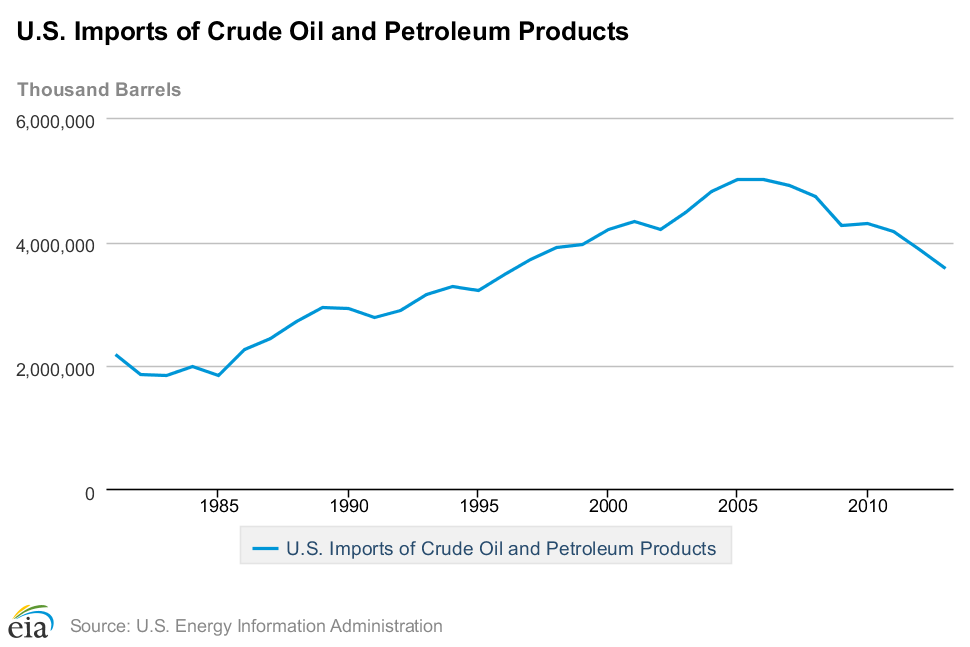

The fact that the US's net imports of crude oil & petroleum products has shrunk in the past few years is touted as evidence that the US can achieve "Energy Independence." However, it is mainly a misrepresentation of facts, or a misunderstanding of the data.

At the surface, it looks very good. The US is now producing more oil than it has since 1989, and net imports have fallen to about 6.2 million barrels per day -- lower than net imports of 1991 and 1988 (the historical high was 2005's net imports of 12.5 million barrels/day).

However, total imports have not followed exactly the same curve, and are substantially larger than net imports.

There are several reasons for this. The biggest factors are:

- Total imports minus exports equals net imports; the United States is one of the largest petroleum product exporters in the world, despite the fact that it routinely consumes more product than it produces.

- Total imports have fallen in general, while exports have increased dramatically.

- US consumption of crude oil and petroleum products is presently at its lowest point since 1997/1998. Per capita oil consumption is at its lowest point in over 50 years.

- Domestic oil stocks; an on-hand supply of oil and petroleum products that have already been produced and/or refined, but not yet sold/consumed.

- Refining gains; simply put, is the reality that the refining process creates gains in volume from barrels of crude oil to barrels of refined product.

- US oil companies sometimes import crude, refine it, and then export it or sell it domestically as a domestic product.

US oil exploration & production has been swiftly ramped up in part due to President Obama's "All of the Above" energy strategy, and relentless political pressure by the oil & gas industry. "New" oil discoveries and "new" technologies have made it possible to slingshot the US into accelerated production.

(The word "new" is in quotation marks because the only thing that's truly new about these oil resources and extraction methods is that the political advantages and price of oil are finally high enough to warrant these types of operations).

US oil production is currently higher than it has been at any time since 1989. That's not bad. To some, it looks like the United States is finally on the road to self sufficiency.

| |

|

| |

|

Comparing US oil consumption to oil production data also reveals that one reason total imports & net imports have fallen is partly due to rising efficiency. However, consumption has also fallen because of high oil prices:

|

| The above graph shows US oil production & consumption, represented by yellow & green bars, respectively. The blue line represents US oil consumption per capita. Data depicted in Barrels per DAY. |

The gains in efficiency/conservation of oil consumption have been exemplary over the last 35 years. However, the main motive for increasing efficiency/conservation seems to be high oil prices. When the prices fall, consumption appears to rise slightly or stay stable. This next graph shows oil consumption per capita over the price per barrel (inflation adjusted):

|

All that is fairly obvious and basic economics. The bottom line looks very good on a dollar-for-dollar basis. While oil prices are fairly high, oil companies can continue to use these "new" techniques to open up these "vast" US oil resources that were previously unprofitable to extract. That opens the door to further innovations that may bring down the price of oil, right? Won't the US be able to produce more and more oil until it has no reason to import, thereby achieving "Energy Independence?"

...Probably not. As implied earlier, the fact is that even at peak production in 1970, the US was still only producing about half as much oil as the country currently consumes each day.

The thing is that the oil that US companies are drilling for right now is simply not as easy to get as it was in the 1970's. Once the US hit its peak, it took more and more oil rigs to locate discoveries & produce even fewer barrels of oil than the year before:

|

| There are many other kinds of oil rigs in use in the US, but rotary rigs account for more than 80% of oil production. |

The reason for this is decline rates- when wells are tapped, they produce huge volumes of oil for the first few years, then taper off to a fraction of their original production volume. When the decline rates fall past a certain "economic" limit, oil companies sell them to smaller companies or simply seal them off.

While prices remain high, politicians remain under intense pressure to open up private and public lands to new oil & gas operations. In order to achieve the same oil production that the US had in 1989, oil companies have three times as many oil rigs in operation searching for more profitable plays.

How much of its own oil would the US have to produce to be considered "Energy Independent?" Eighty percent? Ninety percent? One Hundred percent?

Given that the US has over 1,400 crude oil rotary rigs in operation today, and produces only about 48% of the oil it consumes, how many rigs would it need to achieve 100%? How many new plays must be discovered & how many new wells have to be tapped each year to sustain that rate?

That's why the situation is very much like that scene in "Through the Looking Glass." The US will have to run faster and faster each year just to stay in the same place.

UPDATE:

For reasons that are complex enough to deserve probably an entire mini-series of blog posts, the price of oil dropped substantially in recent months. The main result of this will be scaling back on exploration & discovery, fewer new off-shore and hydraulic fracturing projects across the board, and possibly closing down some of the less profitable operations by both small and large oil & gas companies. A bit down the road (depending on how long this all lasts) we may see some mergers & acquisitions among oil companies-- but we'll definitely be seeing some of the smaller/newer operations closing down or filing bankruptcy.

Few of us can accurately guess how long this oil price collapse will last, but it's likely to shape the way the world will produce oil for the next few years (at least) and will likely secure Saudi Arabia as the #1 oil exporter in the world-- putting the US back down to #2.

This type of market instability is disruptive to the economy as a whole and (in my personal opinion) is further evidence of the need to develop & deploy more alternative energy solutions!

For more info FAQ about Rotary Rigs and how these counts are performed, go to:

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsfaqs

How much of its own oil would the US have to produce to be considered "Energy Independent?" Eighty percent? Ninety percent? One Hundred percent?

Given that the US has over 1,400 crude oil rotary rigs in operation today, and produces only about 48% of the oil it consumes, how many rigs would it need to achieve 100%? How many new plays must be discovered & how many new wells have to be tapped each year to sustain that rate?

That's why the situation is very much like that scene in "Through the Looking Glass." The US will have to run faster and faster each year just to stay in the same place.

UPDATE:

For reasons that are complex enough to deserve probably an entire mini-series of blog posts, the price of oil dropped substantially in recent months. The main result of this will be scaling back on exploration & discovery, fewer new off-shore and hydraulic fracturing projects across the board, and possibly closing down some of the less profitable operations by both small and large oil & gas companies. A bit down the road (depending on how long this all lasts) we may see some mergers & acquisitions among oil companies-- but we'll definitely be seeing some of the smaller/newer operations closing down or filing bankruptcy.

Few of us can accurately guess how long this oil price collapse will last, but it's likely to shape the way the world will produce oil for the next few years (at least) and will likely secure Saudi Arabia as the #1 oil exporter in the world-- putting the US back down to #2.

This type of market instability is disruptive to the economy as a whole and (in my personal opinion) is further evidence of the need to develop & deploy more alternative energy solutions!

For more info FAQ about Rotary Rigs and how these counts are performed, go to:

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsfaqs

According to an international finance group, agriculture is a major source of livelihood throughout the world, especially for the majority of poor people living in rural areas in developing countries. A key challenge for the majority of these farmers is access to finance. Lack of access to finance is a key impediment to farmers in improving the efficiency of their productions and adopting better technologies. So, to have a better understanding about agricultural finance is a very important thing to the farmers or other people that may relate to it in their daily life. So that, after reading this artikel, we may have the understanding about the financial concepts and the practical applications of finance that is essential for anyone, especially the important managerial problems in agriculture that involve finance.

ReplyDeleteContact pedroloanss@gmail.com for agricultural loans and other kinds of loans at the rate of 2%.