A friend of mine commented on this meme posted on Facebook by the page "I Acknowledge Class Warfare Exists." I personally couldn't help but fact-check this particular meme, as it (and memes like it) have been circulating Facebook quite often recently.

I thought it sounded a bit spurious, so I decided to check it out in a few different contexts before looking at the exact context of the meme. It seemed like a good fit for matching the rate of increase of the United States's GDP since 1968.

First, one can visit the Bureau of Economic Analysis website and download an .xls spreadsheet titled "Current dollar and 'Real' GDP." Once you've done that, you can calculate the rate of increase of the current dollar GDP, create a new column and apply each year's growth rate to the base minimum wage of 1968 (non-farm minimum wage in 1968 was $1.60/hour). Once finished, your spreadsheet will inform you that the minimum wage, if it had increased at the same rate as GDP, would have been $27.57 per hour by 2012. Overshot by about 21%.

That metric is perhaps a bit unfair, however, since $1.60 in 1968 is equivalent to $10.34 in 2011 dollars (in case you were wondering how Dad afforded to pay his own way through college while working at McDonald's). So by that same measure, the minimum wage would actually be $34.45 per hour if it had kept up with percent increases in Real GDP (2011 dollars)... overshot by about 50%.

Then I thought that I'd actually heard this kind of comparison made before to CEO pay. However, CEO's in 1980 were making around 30-45 times the salary of their average worker, and by 2012 that figure had ballooned (at least in the US) to over 420 times the salary of the average worker. At that rate of increase, minimum wage would be well over $80.00 per hour... so that can't be right. Overshot again; this time by over 250%!

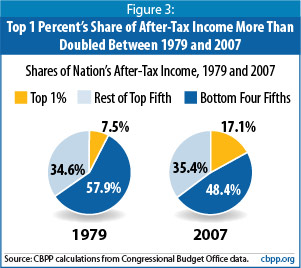

Then I checked out the actual claim made by the meme; I used a Google Image Search with search terms "income top 1% increase" and came up with results that looked like this*:

*I don't know where all of the information comes from, although most of these are sourced to the Congressional Budget Office.

|

| The only one that includes data AFTER 2007 was one from the NY Magazine's website, which does not give a source for the data: http://nymag.com/daily/intelligencer/2012/05/mitt-romney-bain-capital-and-the-1-economy.html |

So each of these shows pre-Financial Crisis incomes of different groups, with the one exception being the image from NYmag's article (which has un-sourced data). Most of these show Top 1% incomes to have increased somewhere between 270% - 350% since 1979/1980.

Federal minimum wage is currently $7.25/hour. In 1980, it was $3.10/hour. So if we don't adjust for inflation, then the minimum wage gain (if it were to keep up with the Top 1%) would be somewhere between 2.5 & 3.5 times $3.10 per hour. That's not even close to $22.62 (but on the high end, it still would be more than the current federal minimum wage).

If however, we were to adjust for inflation as I suspect the source data does-- then the 1980 "Real" minimum wage in 2013 dollars would have been $8.79. Comparing that to the growth of income of the Top 1% would certainly bring us in the range announced by this meme-- between $21.97/hour & $30.77/hour.

So the meme is correct, IF and ONLY IF we apply certain (undisclosed by the meme creators) metrics to the analysis.

1. Inflation-adjusted - this one always makes sense if we want dollar amounts to be meaningful in anyway across decades.

2. Start time - The Federal Minimum Wage was adjusted in 1980 from $2.90/hour to $3.10/hour

3. End time - data series is incomplete for years following 2007

However, I will point out once again that Federal Minimum Wage, adjusted for inflation, has actually decreased overall since the aforementioned inflation-adjusted 1968 rate of $10.34/hour. Since 1980, the Federal Minimum Wage has drifted significantly downward in Real terms, with only the adjustment in 2009 bringing minimum wage close to its 1980 equivalent value. Oregon State University did a study on this several years ago. Here is a graph of their findings:

Since minimum wage has never been legislated to increase with any kind of CPI adjustment, we frequently see "Real Dollar" amounts at peaks that fall for several years until a new adjustment is made at irregular intervals.

If minimum wage were designed to keep up with the Top 1%'s income growth, its growth would be wildly erratic, but it would still be growing. As it has been since 1968, federal minimum wage has shrunk, and none of the subsequent adjustments have ever come close to returning it to a wage comparable to the rate that was paid in 1968.

The analysis overall is that the meme posted by the Facebook page "I Acknowledge Class Warfare Exists" is technically correct.

Although it's only fair to point out that according to any/all of the alternate scenarios suggested, the minimum wage would be even higher than the one claimed in the meme... unless you don't adjust for inflation over the past 45 years*. But who doesn't adjust for inflation?

Oh. Right.

*According to the parameters of this meme, even the current dollars (not inflation-adjusted) amount of minimum wage would be higher than the current federal minimum wage, if it had kept pace with income growth of the top 1% at the lowest estimated growth rate... if you start counting any time before 2004.

_1950_-_2010.jpg)